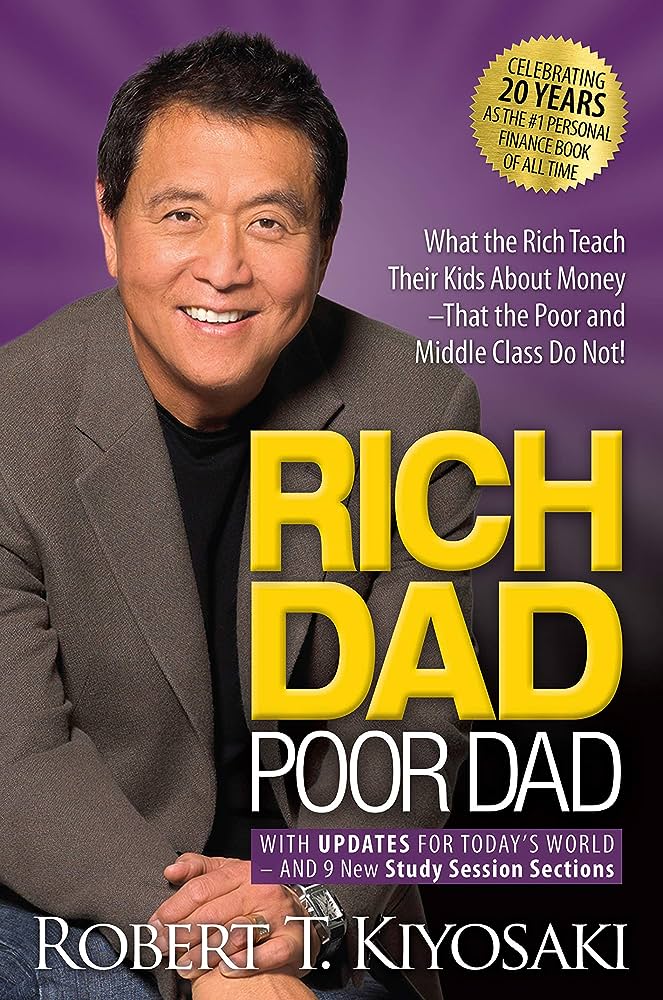

Welcome to Thinkers Books, a haven for those who seek wisdom and growth through literature. Today, we explore a transformative book that has reshaped how millions perceive money and personal finance – ‘Rich Dad, Poor Dad’ by Robert Kiyosaki.

In ‘Rich Dad Poor Dad’, Kiyosaki shares his unique experiences with two paternal figures: his biological father, a well-educated man who struggled financially, and his best friend’s father, a high school dropout turned successful entrepreneur. Kiyosaki divulges the secrets to building wealth and achieving financial freedom through these contrasting perspectives.

Central to the book are three key concepts: financial education, entrepreneurship, and investing. Kiyosaki emphasises the shortcomings of traditional education in teaching us how to manage our finances. He advocates for self-education, entrepreneurial endeavours, and intelligent investments as pathways to take control of our financial destinies.

Let’s delve deeper into the wisdom embedded in ‘Rich Dad Poor Dad’. Here are my top 5 learning points from the book:

- The Rich Don’t Work for Money: Kiyosaki reveals that wealthy individuals let their money work for them rather than exchanging their time for money. They invest in assets, such as real estate, stocks, and businesses, generating passive income and paving the way to financial freedom.

- Financial Literacy is Key: The book’s importance of financial education is a recurring theme. Understanding the difference between assets and liabilities, interpreting financial statements, and mastering cash flow management are essential skills for accumulating wealth.

- Mind Your Own Business: Kiyosaki encourages readers to become entrepreneurs and create their income sources. Developing a side hustle or starting a business can lead to financial independence beyond the confines of a traditional job.

- Leverage the Power of Debt: Kiyosaki argues that debt, when used wisely, can be a potent tool. He illustrates how the wealthy use debt to acquire assets and grow wealth, while the poor often misuse debt, leading to financial hardship.

- Continuous Learning and Self-Improvement: Lifelong learning and personal development are emphasised throughout the book. Investing in ourselves through education, mentorship, and skill-building can unlock our potential and build lasting wealth.

‘Rich Dad Poor Dad’ teachings have significantly impacted my financial journey, shifted my mindset, and influenced my financial decisions. This book is a must-read for anyone aspiring to accumulate wealth and attain financial freedom.

As we conclude our exploration of ‘Rich Dad Poor Dad,’ remember these inspiring words from Robert Kiyosaki: “The only difference between a rich person and a poor person is how they use their time.” Let’s invest our time wisely, learn continuously, and create the financial future of our dreams.

We invite you to continue your journey of discovery with more insightful summaries here at Thinkers Books. Your thoughts and experiences with ‘Rich Dad Poor Dad’ are welcomed. Keep learning, growing, and harnessing the transformative power of literature with Thinkers Books.